This will help you determine whether you have enough money saved for retirement. (Or make changes directly in any accounts they manage under the premium service.) You are also assigned a personal advisor you can contact anytime. Personal Capital will suggest changes in those accounts to create an optimal allocation. You enter all of your financial accounts onto the platform, and then they are evaluated. This is a personal analysis of your financial situation, including an assessment of the risks and opportunities available.

#Mint budget price free#

Personal Capital also provides certain investment services under the free version. Private Client Group provides personalized investment services and wealth planning, including direct access to a certified financial planner. It provides a progressively lower fee structure, with fees declining as your portfolio grows (see below). This is the investment service offered for individuals who invest a minimum of $1 million on the platform. Capital gains generating assets are likely in taxable accounts, where they can take advantage of lower long-term capital gains tax rates. This is the process of having various assets in the most tax-advantaged account.įor example, assets that produce interest and dividend income are likely in tax-sheltered retirement plans.

They also include tax allocation with the investment service. The strategy keeps short-term capital gains to a minimum, which minimizes your tax liability. TLH is an investment strategy involving selling losing investments to offset gains on the sale of winning positions. Personal Capital offers this with the premium investment management service. The positions are maintained through index funds, but if your portfolio exceeds $100,000, they will also include individual stocks. The portfolio will be allocated between US stocks and bonds, international stocks and bonds, and commodities. When you sign up for the service, they start by determining your risk tolerance, your investment goals, and your personal preferences.įrom that, they design an investment portfolio based on Modern Portfolio Theory (MPT), which is typical of robo-advisor services. The investment management service requires a minimum of $25,000 under management. This gives you more comprehensive investment management than you typically see in automated investment management platforms. That means that in managing specific investment accounts, Personal Capital also considers other investments it does not manage, such as an employer-sponsored retirement plan.

Where Personal Capital differs from typical robo-advisors is that not only do they manage the investments that you include in the service, but they also act as a financial account aggregator. This service is only available on the premium version, and it’s what Personal Capital does best. Get clarity on your money, with tech you can trust from Personal Capital Investment Management The budgeting function is available for both the free and the premium versions. You can also use the Cash Flow Analyzer to establish long-term goals, like retirement planning or getting out of debt. The money management app will alert you to upcoming bills, however, there is no bill-paying function on the platform.

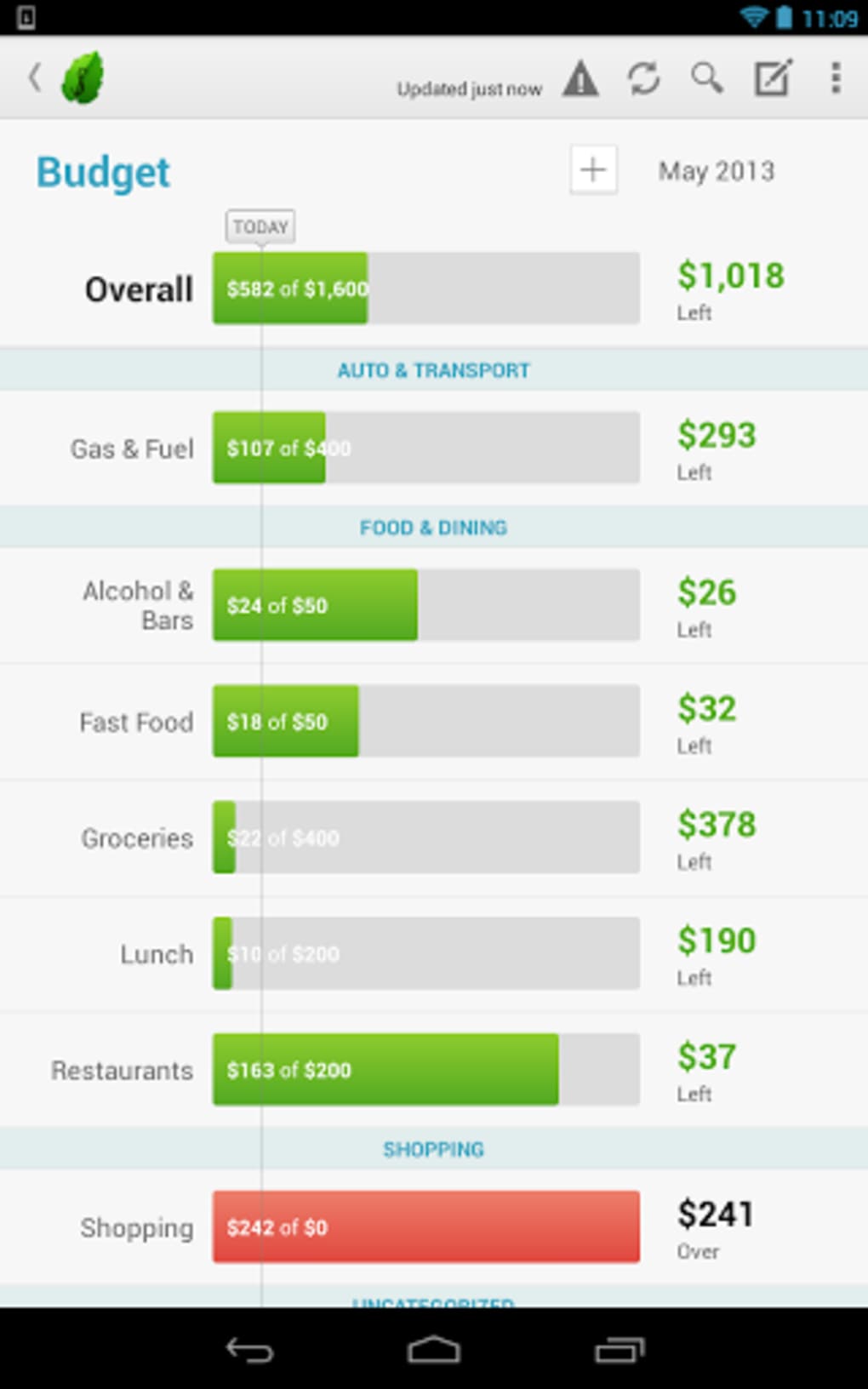

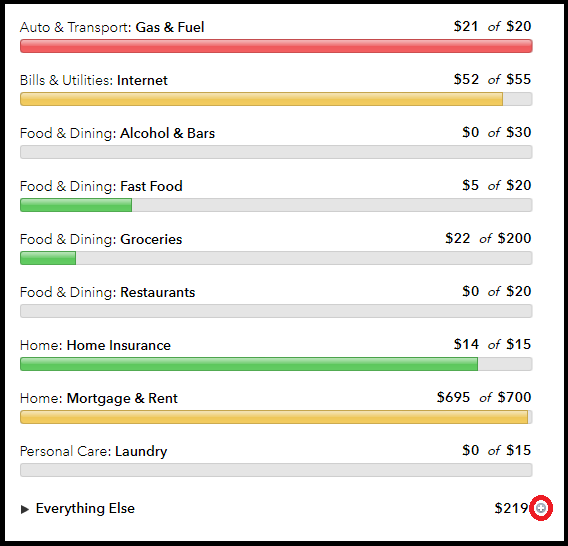

This will also help you to pay your bills on time and to track your spending. They provide a Cash Flow Analyzer tool that enables you to establish a budget by tracking your income and expenses from all accounts and sources. You do this by linking your various bank accounts and credit cards to the Personal Capital app. This can help you know exactly where your money goes each month. It can also allow you to view and analyze the transactions in your budget and provide monthly summaries. For example, Personal Capital lets you track your cash flow and provide insights into your spending habits. Personal Capital does offer a budgeting function, but when compared to that offered by Mint, it’s extremely limited. Here are the services that Personal Capital provides: Budgeting & Cash Flow Management So you can sign up for a free Personal Capital account and use their online suite of tools as long as you wish. There is no obligation to sign up for the Personal Capital Wealth Management service. Both versions offer you the various tools and features on the platform, but the premium version provides active investment management, similar to that of robo-advisors. They offer two services, the free version, and a premium wealth management service. Over 1.4 million people use the service to track more than $350 billion in assets.

Here’s why you should choose Personal Capital over Mint What Personal Capital DoesĪs noted above, Personal Capital is primarily an investment management service.

0 kommentar(er)

0 kommentar(er)